Mileage Claim For Self Employed . Keep accurate records to support your claim. steps to claim the deduction: choosing a deduction method. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. to use the standard mileage rate, you must own or lease the car and: Traveling for moving or medical purpose. You must not operate five or more cars at the same time, as in a. What qualifies for standard mileage rate? you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. You must either keep track of your vehicle.

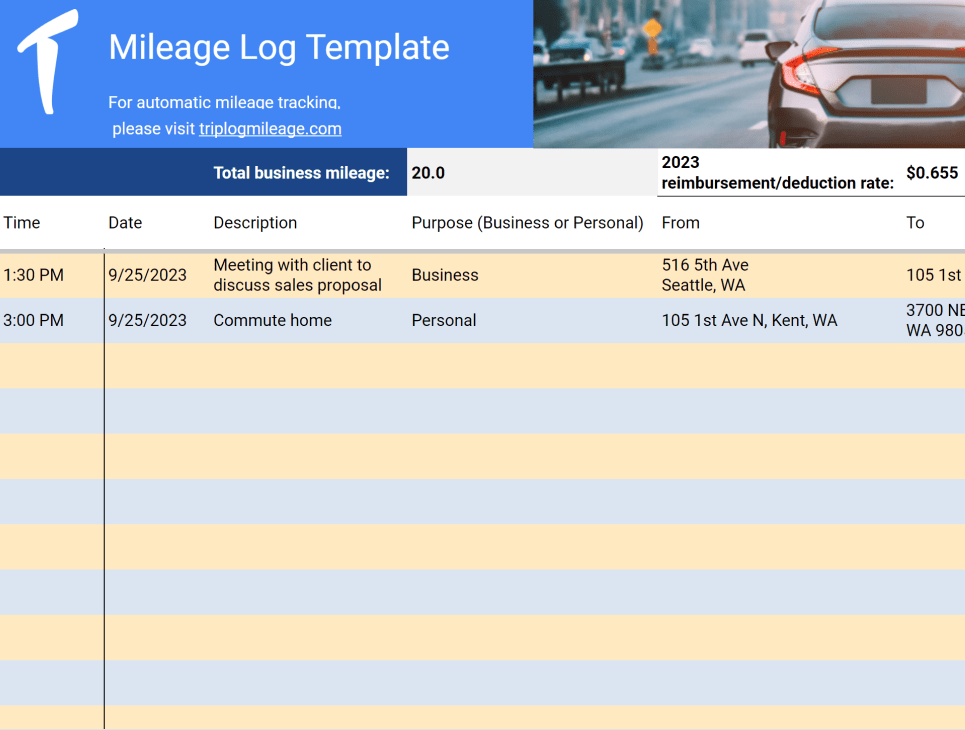

from triplogmileage.com

choosing a deduction method. Keep accurate records to support your claim. steps to claim the deduction: Traveling for moving or medical purpose. You must either keep track of your vehicle. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. You must not operate five or more cars at the same time, as in a. What qualifies for standard mileage rate? you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. to use the standard mileage rate, you must own or lease the car and:

Free Mileage Log Template Download Company or Selfemployed

Mileage Claim For Self Employed calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. steps to claim the deduction: You must not operate five or more cars at the same time, as in a. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. to use the standard mileage rate, you must own or lease the car and: What qualifies for standard mileage rate? You must either keep track of your vehicle. choosing a deduction method. Keep accurate records to support your claim. Traveling for moving or medical purpose.

From listentotaxmanusa.com

How to claim mileage allowance when you are selfemployed Tax Guides Mileage Claim For Self Employed choosing a deduction method. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. Keep accurate records to support your claim. to use the standard mileage rate, you must own or lease the car and: You must not operate five or more cars at. Mileage Claim For Self Employed.

From goselfemployed.co

Business Mileage Spreadsheet for the SelfEmployed Mileage Claim For Self Employed steps to claim the deduction: you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. Traveling for moving or medical purpose. You must either keep track of your vehicle. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs. Mileage Claim For Self Employed.

From www.goforma.com

SelfEmployed Guide How to Claim for Business Mileage Mileage Claim For Self Employed choosing a deduction method. Traveling for moving or medical purpose. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. steps to claim the deduction: What qualifies for standard mileage rate? You must either keep track of your vehicle. to use the standard. Mileage Claim For Self Employed.

From www.coreadviz.co.uk

Vehicle Expenses vs Mileage Claim for SelfEmployed Business Mileage Claim For Self Employed You must either keep track of your vehicle. to use the standard mileage rate, you must own or lease the car and: What qualifies for standard mileage rate? Keep accurate records to support your claim. Traveling for moving or medical purpose. choosing a deduction method. steps to claim the deduction: you may be able to calculate. Mileage Claim For Self Employed.

From www.icompario.com

SelfEmployed Mileage Allowance A 2022 Guide Mileage Claim For Self Employed Traveling for moving or medical purpose. to use the standard mileage rate, you must own or lease the car and: you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. steps to claim the deduction: calculate your vehicle expenses using a flat rate. Mileage Claim For Self Employed.

From www.pinterest.com

Mileage Logbook 366 Day Mileage Tracker for Taxes, SelfEmployment Mileage Claim For Self Employed Keep accurate records to support your claim. steps to claim the deduction: Traveling for moving or medical purpose. to use the standard mileage rate, you must own or lease the car and: choosing a deduction method. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your. Mileage Claim For Self Employed.

From www.zervant.com

Free UK Mileage Log Zervant Blog Mileage Claim For Self Employed choosing a deduction method. Traveling for moving or medical purpose. You must not operate five or more cars at the same time, as in a. steps to claim the deduction: you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. What qualifies for standard. Mileage Claim For Self Employed.

From wssufoundation.org

Self Employed Mileage Log Template Mileage Claim For Self Employed You must not operate five or more cars at the same time, as in a. Keep accurate records to support your claim. choosing a deduction method. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. What qualifies for standard mileage rate? to use. Mileage Claim For Self Employed.

From templatelab.com

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage Claim For Self Employed calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. to use the standard mileage rate, you must own or lease the car and: You must either keep track of your vehicle. Traveling for moving or medical purpose. choosing a deduction method. You must. Mileage Claim For Self Employed.

From www.amazon.com

Mileage Log Book For Taxes For Self Employed Mileage Mileage Claim For Self Employed You must not operate five or more cars at the same time, as in a. to use the standard mileage rate, you must own or lease the car and: Traveling for moving or medical purpose. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example.. Mileage Claim For Self Employed.

From wssufoundation.org

25 Printable Irs Mileage Tracking Templates Gofar Self Employed Mileage Mileage Claim For Self Employed You must either keep track of your vehicle. What qualifies for standard mileage rate? to use the standard mileage rate, you must own or lease the car and: Keep accurate records to support your claim. Traveling for moving or medical purpose. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying. Mileage Claim For Self Employed.

From www.ridesharetaxhelp.com

How to Claim the Standard Mileage Deduction Get It Back Mileage Claim For Self Employed calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. steps to claim the deduction: you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. to use the standard mileage. Mileage Claim For Self Employed.

From mileiq.com

Free Mileage Log Template for Taxes, Track Business Miles Mileage Claim For Self Employed calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. to use the standard mileage rate, you must own or lease the car and: Traveling for moving or medical purpose. steps to claim the deduction: choosing a deduction method. Keep accurate records to. Mileage Claim For Self Employed.

From goselfemployed.co

How to Claim the Work Mileage Tax Rebate Mileage Claim For Self Employed choosing a deduction method. steps to claim the deduction: Traveling for moving or medical purpose. Keep accurate records to support your claim. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. You must either keep track of your vehicle. You must not operate. Mileage Claim For Self Employed.

From www.businessaccountingbasics.co.uk

Simple Mileage Log Free Mileage Log Template Download Mileage Claim For Self Employed You must either keep track of your vehicle. steps to claim the deduction: calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. What qualifies for standard mileage rate? Keep accurate records to support your claim. choosing a deduction method. you may be. Mileage Claim For Self Employed.

From www.printablee.com

Mileage Log Sheet Template 10 Free PDF Printables Printablee Mileage Claim For Self Employed You must not operate five or more cars at the same time, as in a. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses). Mileage Claim For Self Employed.

From printablestemplate.com

Printable Mileage Log Template For Self Employed Printables Template Free Mileage Claim For Self Employed choosing a deduction method. What qualifies for standard mileage rate? you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for example. Traveling. Mileage Claim For Self Employed.

From minasinternational.org

Mileage Claim Form Template Mileage Claim For Self Employed steps to claim the deduction: You must not operate five or more cars at the same time, as in a. choosing a deduction method. you may be able to calculate your car, van or motorcycle expenses using a flat rate (known as simplified expenses) for mileage instead. You must either keep track of your vehicle. to. Mileage Claim For Self Employed.